maine tax rates for retirees

If you are a public. MaineSTART offers both Traditional pre-tax and Roth after-tax accounts.

Maine State Tax Guide Kiplinger

These voluntary programs can help eligible public school teachers supplement their retirement.

. For deaths in 2020 the estate tax in maine applies to taxable estates with a value over. The income tax rates are graduated with rates ranging from 58. Individual Income Tax 1040ME Maine generally imposes an income tax on all individuals that have Maine-source income.

Is maine a tax friendly state for retirees. For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov. How does Maines tax code compare.

Maine tax rates for retirees. Permanently exempted groceries from the state sales tax in 2022. Maine with a tax burden of just over 10 is the ninth highest in the country.

Recipients are responsible for state taxes in the state in which they reside. Maine Income Tax Calculator 2021. State tax on social security.

A manual entry will be made using the Maine State wages found in Box 14 of 1099-R. See below Pick-up Contributions. Maine with a tax burden of just over 10 is the ninth highest in the country.

Payment Vouchers for the 2022 tax year. If you believe that your refund may be. Average property tax 607 per 100000 of assessed value 2.

Your average tax rate is 1198 and your marginal tax rate is 22. Maine is not the best state in terms of retirement taxes. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a.

Taxes in Maine Maine Tax Rates Collections and Burdens. Maine tax rates for retirees. Maine tax rates for retirees.

Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022. Subtract the amount in Box 14 from Box 2a. If you make 70000 a year living in the region of Maine USA you will be taxed 12188.

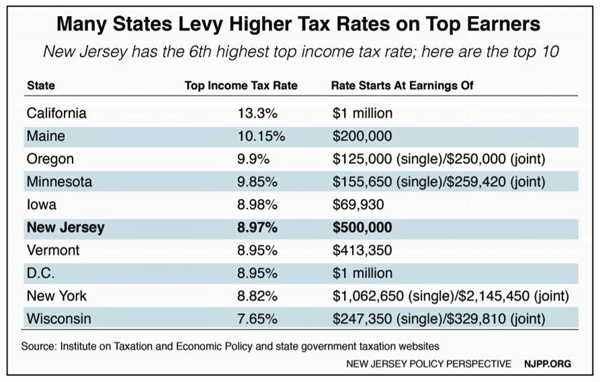

Other states provide only partial exemption or credits and some tax all retirement income. Maine has a graduated individual income tax with rates ranging from 580 percent to 715. Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement.

The state income tax is very low starting at 3. 1418032 - 1289097.

![]()

Opinion A Recent History Of Maine S Swiftly Evolving Tax Code Maine Beacon

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

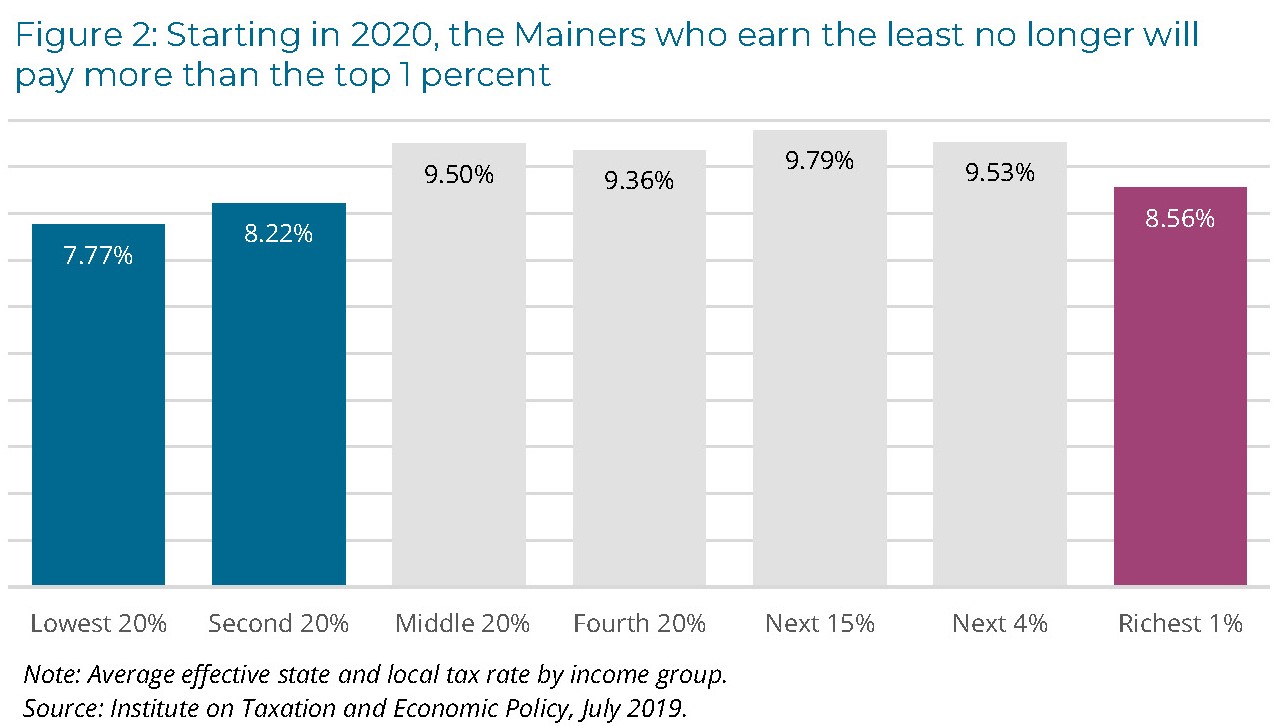

Maine Reaches Tax Fairness Milestone Itep

Maine Retirement Tax Friendliness Smartasset

Concerned Taxpayers Of Scarborough Maine The Town Of Scarborough Has Now Provided Preliminary Information On The New Tax Rate Or Mil Rate For Next Year And As Most Of You Already

Gasoline And Diesel Tax Rates In Maine 1997 2010 Statista

Progressive Tax Hike Proposal Attacks Illinois Working And Middle Classes

The Provocative Millionaire S Tax Its Potential And Past In N J Whyy

File Your 2021 2022 Maine State Income Tax Return Now

Property Taxes Urban Institute

Maine Estate Tax Everything You Need To Know Smartasset

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

State Withholding Tax Table Maintenance Maine W Hx02

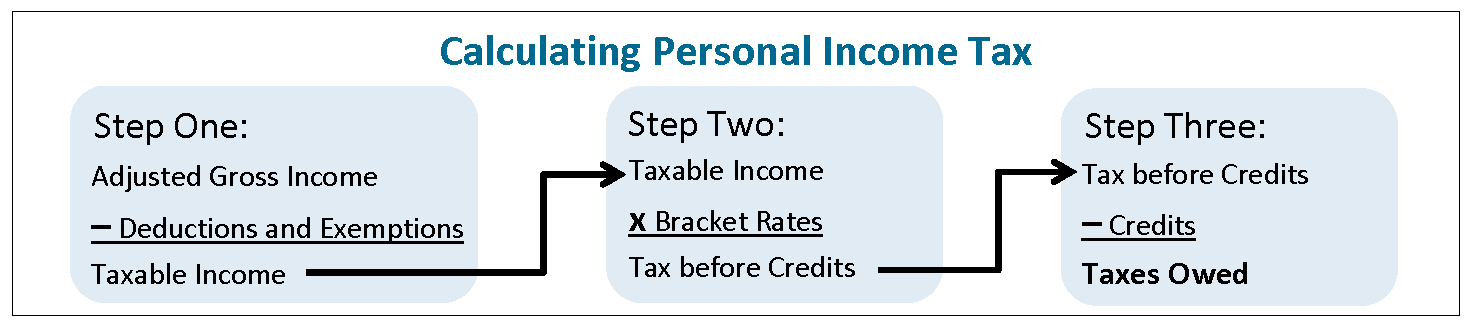

How Maine S Personal Income Taxes Work Mecep

10 Most Tax Friendly States For Retirees Kiplinger

Maine State Tax Refund Tax Brackets State Tax Deductions

How Do State And Local Property Taxes Work Tax Policy Center